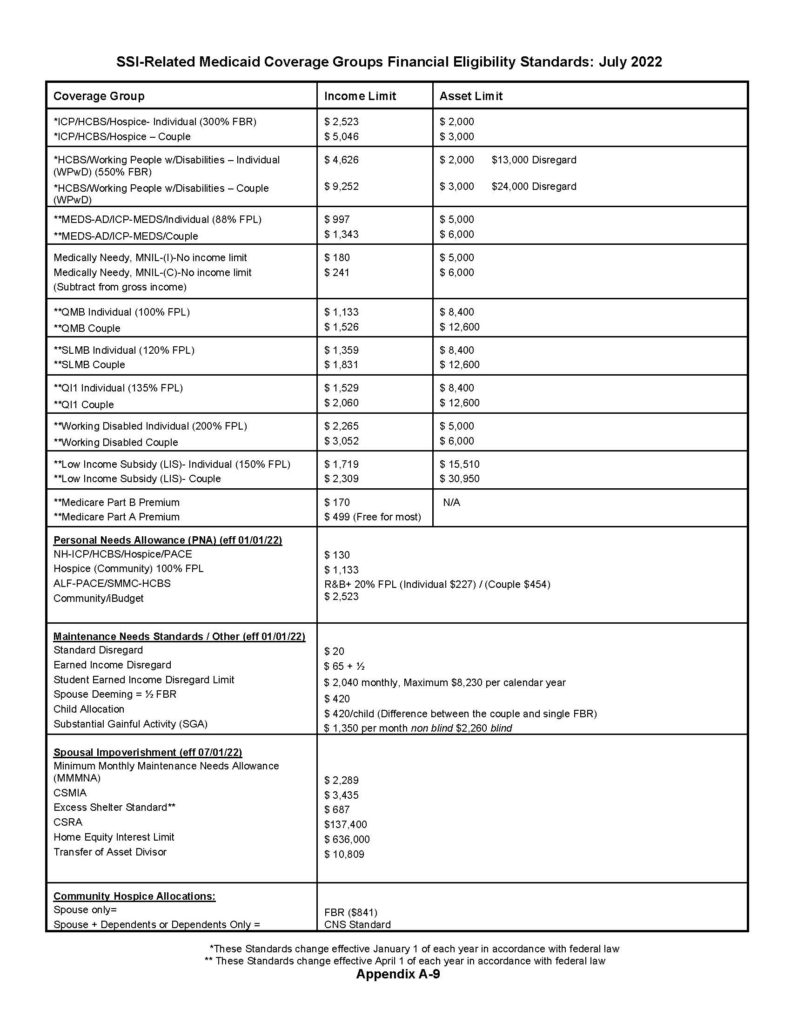

2022 SSI & Spousal Impoverishment Standards

SUPPLEMENTAL SECURITY INCOME (SSI) EFFECTIVE JULY 2022

Click here to download the report.

Who should read this notice: Wartime Veterans, their spouses, their relatives, caregivers and advisors.

Critical Planning and Eligibility Update

The VA has implemented major new rules governing VA pension including the “Homebound” and “Aid and Attendance” programs. These programs provide cash reimbursement to wartime Veterans and spouses whose care expenses are close to or higher than income. The number one use of this money for our clients is to pay for home health aides. The second most common use for our clients would be payment towards assisted living facilities.

Effective October 18, 2018, the VA will be imposing gift penalties. This means that if an applicant or spouse has made gifts after October 18th, the VA will take away eligibility. Gifts made prior to October 18th will not affect eligibility even if application is made after that date.

This notice explains the very basics.

Wartime Vets and their spouses should set an appointment. Limited appointments are available on a first call-first come basis. The meeting or call is provided at no charge for our existing Family Asset Protection Planning clients.

Estate planning happens after death and elder care law plans for those facing aging issues, according to board-certified elder care attorney Scott Solkoff.

He spoke about the ethics and benefits of long-term care asset protection planning at a recent session of the ACE Lifelong Learning Center at Mandel JCC of the Palm Beaches, 8500 Jog Road, in Boynton Beach.

Solkoff joined his father Jerome Ira Solkoff’s law firm 22 years ago. His father co-founded the Elder Law Section of the Florida Bar in 1991, serving as chairman from 1991 to 1993. Scott Solkoff was chairman from 2003 to 2004 when membership was 1,600. Today it is 1,700.

“Elder care laws were passed in 1980. Elder care is ‘real stuff’ helping seniors,” Scott Solkoff said. “For many, the immediate question is why they can’t simply rely on their savings, health insurance, retirement and Social Security. The assumption is that with some basic preparation and existing government programs their future is planned for.

“The problem is it fails to account for two things: the high out-of-pocket costs for the growing needs of the elderly and the difficulty of navigating the existing government programs that may be able to assist.”

Solkoff cited a 2016 Genworth study quoted in a Forbes article: “Nearly a third of Americans (30 percent) believe home health care expenses are under $417 a month, but according to Genworth’s number crunching, the national median rate is about nine times that.”

“Most people have a revocable living trust,” he said. “If incapacitated, money you have is used for your care, for your protection while still alive. It is used to avoid probate. Recommended by elder care lawyer specialists is an irrevocable trust document.”

Solkoff related a case history.

ACE Lifelong Learning Center at the Mandel JCC has over 100 classes Monday through Friday covering topics such as history, current events, entertainment and personal growth, among others. Visit JCConline.com/ace or call 561-740-9000.

With a heart-felt show of honor to his father’s legacy, Scott Solkoff was awarded the Jerome Ira Solkoff Advocacy Award at the Academy of Florida Elder Law Attorneys Un-Program on December 1, 2017.

As professional planners and counselors to our clients, we know a great deal about planning ahead and anticipating future needs. As an almost steadfast rule, however, we do not truly practice what we preach. In most cases, we put off our own family’s planning in favor of the work we do for our clients. This article contains the Top 10 Rules for getting aging-ready.As professional planners and counselors to our clients, we know a great deal about planning ahead and anticipating future needs. As an almost steadfast rule, however, we do not truly practice what we preach. In most cases, we put off our own family’s planning in favor of the work we do for our clients. This article contains the Top 10 Rules for getting aging-ready.

1. Talk to your family about your long-term care future. These are not easy or fun discussions to have but without such talks, you will not be sure how to help with your future and you will lack the best tools. You can use this article as an excuse to get the conversation started. Good discussions result in an action list so that important planning opportunities are not lost. Ask yourself where you wish to live if you cannot care for yourself. Have you considered how to pay for the care that may be required? Have you considered what health care you wish to be provided if you are in a terminal, vegetative or end-stage condition. Who would you like to help if you can no longer make decisions on your own. Do you have any insurance (i.e., long-term care insurance, catastrophic health care coverage or similar policies). Where do you keep your important papers and who would you feel comfortable with having copies of your key documents now.

2. A special long-term care Durable Power of Attorney is the single most important document you can sign. A power of attorney document can allow you to pick a person or persons who can step in and do for you if you cannot do for yourself. Even regular powers of attorney can be immensely helpful but there is special language that can be added to powers of attorney for aging and long-term care issues. Some provisions to consider: specific authorization for the agent(s) to create trusts to protect income (general trust creation provisions are not sufficient); authorization (where desirable) for the agents to gift to themselves; authorization to sign admissions agreements for life care facilities; authorization to apply for health and long-term care insurance benefits and to make claims; authorization to apply for government benefits. Some general powers of attorney will work but some third-parties, including the government, will require specificity. Remember that the power of attorney does not give away any of your rights. It simply appoints a helper, albeit one with great authority.

3. Do a new Deed for the home. In most cases, my office recommends a new Deed for the home both to avoid a probate proceeding and to plan ahead should we need to apply for Medicaid. In many cases, we advise the creation of a new deed whereby the home is owned by you for the rest of your life and then, immediately upon death, the property automatically passes to the heirs. Unlike a traditional life estate deed, however, there is no loss of Medicaid eligibility and also unlike a traditional life estate deed, you retain total control. You should NEVER transfer title to anyone else as joint owners or otherwise, without speaking to an Elder Law Attorney as this can cause a loss of Medicaid eligibility and a loss of the homestead creditor and property tax protection.

4. Consider Long-Term Care Insurance. While it is true that my office can most likely show you how to legally shelter your assets and qualify for Medicaid if and when you need it, long-term care insurance can still be important. Contact a reliable independent agent who will show you quotes, terms and ratings from more than one insurer. You may also contact captive agents who sell primarily for only one company but you should then check with others also. Have an Elder Law Attorney review the policy to make sure you buy what you need and nothing more. Talk to the agent about a policy for you as well.

5. Even with significant assets, you may need to qualify for Medicaid. Medicaid is the government program that pays for the cost of long-term care. Medicaid can pay for home care, assisted living, and nursing home care from even the Rolls Royces of providers. In order to qualify, you must be below the government’s financial caps. But, the government is not allowed to count everything and lawyers have also figured out legal ways of converting countable assets to non-countable assets, often without any penalty period. It is possible, through careful and time-tested planning, to legally convert countable assets to Anon-countable assets. Why is this important? Because without planning, you will only qualify for Medicaid after spending all or most of your assets and will then have nothing left to pay for all that Medicaid does not cover. What was once a program for the very poor is now necessarily a program for the middle class as well. That is because nursing home care exceeds $10,000 per month for just one person in a semi-private room. Start planning now or, at the very least, get the documents in place that will allow for future asset protection planning.

6. Procure detailed written directions about end-of-life decision making. One to two page living wills just do not cut it. It takes that long for a good document just to define the terms. I have found that what works best is an integrated package which contains a heath care surrogate designation, living will and health care power of attorney and then explains how these documents interrelate. Great specificity is desired while also leaving enough flexibility to accomplish unanticipated goals. It is not enough to say I do not want artificial procedures, without then carefully defining what is meant by that term. Also, it is important that the document deal with such issues as relieving the surrogate/agent from liability for health care expenses, relieving the doctor of liability so long as the doctors honors the document and considering different procedures or scenarios. The package we use at Solkoff Legal, P.A. is about eight to ten pages long, not because longer is better but because it takes that long to explain one=s wishes. A good Elder Law Attorney will spend considerable time explaining the choices and the documents. Whether you have one of our thorough documents or a one-page form you got for free, it is important that you supply this document to your primary care physician now. You must also have a copy or know where to get to it quickly.

7. Avoid Probate. In most cases, we want our clients to avoid a probate proceeding. Probate is the legal process by which a person=s estate is managed and then distributed. Under Florida law, there are circumstances when a person=s estate must be probated. Probate is almost always necessary when a person dies owning any assets in that person=s name alone. Probate can therefore often be avoided by placing other persons= names on your assets as beneficiaries or co-owners or through the use of trust agreements or other entities. But beware … trusts, beneficiary designations and especially joint ownership, have significant pros and cons. Consider, for example, what would happen if a joint owner gets sued or dies. Consider what would happen if the assets that exist now do not exist in the future and how that will affect the division of assets.

8. Avoid Gifts. Gifts can disqualify people from getting Medicaid when they need it. While we can usually fix gifts, there are sometimes irrevocable consequences. If you wish to gift assets, consult with my office to find out how you may transfer assets without incurring Medicaid gift penalties. Generally speaking, the government looks back five years. It is better to therefore make exempt transfers which are not subject to the look-back rules, rather than risk ineligibility later when you need it. Sometimes, making gifts is advisable. For many reasons, we usually set up irrevocable trusts to receive gifts.

9. Consider Exempt Transfers. Depending upon your age and circumstance, it may be advisable for you to begin making changes to your assets now so that you may qualify for Medicaid if and when you need it. Transfers to children or to trusts can be very advantageous but there are also other methods to protect a family=s life savings. With you attorney, you can consider exempt transfers such as putting money into the home (an already exempt asset), paying off a mortgage, making monthly transfers below the penalty levels and transferring assets to children in exchange for fair value (so not a gift and not penalized).

10. Be Realistic about the Future. I have never met a client who was anxious to move into a nursing home. Most people tell me they do not want to enter a nursing home and yet there are waiting lists to get in. The goal should be to remain as independent as possible with as high a quality of life as possible. Usually this means staying at home until it just does not work anymore. Have a plan for moving into a facility. Without a plan, bad things happen.

11. Get a good lawyer on your side. Nobody likes spending money or seeing large attorneys’ bills. The question is whether the benefits outweigh the fees. During your initial consultation, your attorney should be able to clearly demonstrate the value of the work. In most instances, with the right long-term care asset protection planning, the fees are a pittance compared to the savings. We find that fees are rarely an issue for our clients once everything is understood. Good lawyers cost money and the difference between lawyers can be significant. Elder Law is not a formulaic practice where every attorney makes the same recommendation. It is not a commodity like buying a car. It is more like finding the right surgeon and the difference between the right one and the wrong one can be just as impacting. Only a Florida Bar Board Certified Elder Law Attorney meets the Florida Bar requirements to hold themselves out as a specialist. Do your research. Google. Look at Martindale Hubbell, Avvo and other ratings and look at leadership in the field. There are some very good Elder Law Attorneys. Your job is to find one of those and one you can trust. Read more about Solkoff Legal, P.A. and our qualifications.

Introduction

In a course on the “Essentials of Elder Law,” there can be no more a fundamental, core issue than that of end-of-life health care decision making. The right of a person to manifest his or her own health care destiny does not come from words in the constitutions of either Florida or of the United States. Still, the courts have found that some of our most fundamental freedoms appear in both constitutions because they were assumed by our founders to be so inalienable and so fundamental as to be necessary for a free people. Such is the right to control our own health care. The courts have found the right to control our own health care to be grounded in privacy and other more explicit constitutional provisions. John F. Kennedy Memorial Hosp., Inc. v. Bludworth, 452 So. 2d 921, 49 A.L.R.4th 799 (Fla. 1984); In re Guardianship of Browning, 568 So. 2d 4 (Fla. 1990); Cruzan by Cruzan v. Director, Missouri Dept. of Health, 497 U.S. 261, 110 S. Ct. 2841, 111 L. Ed. 2d 224 (1990).

As Elder Law Attorneys, we have the privilege and responsibility to inform our clients about the choices they can make in their own health care. Our clients commonly do not know what questions to ask or even what issues are most important. It is up to us to frame the issues without bias or judgment and to then inform, guide, draft and enforce our clients’ rights. This article and my accompanying talk cover these rights with practice tips such as talking points, drafting tips and citations to the law. This 2015 ‘essentials” article draws from the more complete Chapter 27, “Advance Health Care Directives and Anatomical Gifts” in Solkoff & Solkoff, Elder Law Practice Guide (17th ed. 2015-2016).

Read the full report here – Advance Health Care Directives & Anatomical Gifts

When Rose Baker first came to my elder law attorney office, she had been married to her husband, Joe, for 59 years. They lived their lives together in Massachusetts and retired to South Florida in 1992. When I came out to greet Mrs. Baker in the reading room (we don’t have a “waiting” room), her eyes were puffy, red and she was clutching a wrinkled tissue in one hand. I brought her back to my office where she immediately related her story to me. Joe is ill and in a nursing home. Rose feels overwhelmed, depressed, guilty, scared and lonely. On top of it all, she worries about being poor.

She goes further to explain that she has guilt and remorse for even talking about money because, she feels she should be at the nursing home taking care of what is really important — her husband, Joe. Crying again but trying not to, she feels embarrassed. I lean in from my desk to convey assurance and help her feel better. As an Elder Law Attorney, making her feel better is all I really want to do.

It’s overwhelming

Rose obviously feels overwhelmed with all that is going on in her life. In a burst, she tells me about the doctor at the nursing home, Joe’s most recent hospitalization, her daughter’s multiple sclerosis, her son living “back home” in Massachusetts, the high electric bill because it is so hot, her three CDs totaling $90,000.00, the stock once worth $140,000.00 but now worth only $100,000.00. How Joe used to be an important teacher and how good he was to her and the kids. She is crying off and on. Mrs. Baker reminds me of my grandmother.

I’m so glad I can help

I begin by asking her some questions from our elder law intake form. Instead of having a staff member do this, I do it. These innocuous questions help make wonderful small talk with my clients. Often, new clients are nervous and scared, just like Mrs. Baker and it helps calm things down. As Mrs. Baker and I talk, I write down some notes of my impressions and the answers to the questions using her own words wherever possible.

Elder Law Attorneys talk about the details

Mrs. Baker has two children; a daughter named Hillary and a son name Stephen. Hillary is a “good girl,” suffers from MS and does not “deal well with sad things.” Hillary calls once each week but Mrs. Baker does not want to “burden her.” Mrs. Baker last saw Hillary eight months ago. It is hard for Hillary to travel because of her MS. Stephen is a teacher, having followed in Dad’s footsteps. Stephen is a big help to Mrs. Baker. He was just down for ten days and will be returning next month. Because there is no school in summer, Stephen has some flexibility for the time being.

Mrs. Baker feels panic thinking about the expenses. She just paid the nursing home $5,700.00 for last month alone. “We never spent money like this,” she says. She tells how she and her husband saved and saved their money; how they never had two cars, how Joe “taught me how to put money away for later.” She tells me how Joe does not even recognize her sometimes and she starts crying a lot now.

Even though I know I can help Mrs. Baker as her elder law attorney, I feel frustrated that I cannot do more. I want her to stop crying, to be happy, and to feel secure again. For strength, I strong-arm my emotions aside and stay with my lawyerly, authoritative and assuring pose. My deepest wish is for her to understand that I can help her and that she will feel some precious relief.

Elder Law Attorneys provide solutions to lift the weight

“Mrs. Baker, when you leave here today, I want you to leave with a weight taken off of your shoulders. I cannot fix all of the problems, but I can remove the money problem from your worries.” She exhales some years of worry and her shoulders visibly relax.

“How?” She is wobbling her head and looks incredulous. Then she adds, “The money is not important though.” Even in her excitement to maybe have found some help, she feels guilty that we are talking about “money” when her husband is suffering so much.

“Mrs. Baker,” I continue, “Money buys care. I cannot make your husband all better. No one can. But what we can do is maximize the use of your savings so that he — and you — can get better care. We do this through a process of protecting your savings while accessing any and all benefits that will help you and your husband.”

I am very cool, very assuring. Inside, I want to jump up and hold Mrs. Baker and cry with her and tell her everything will be alright. But I know that I must convey detached professionalism so Mrs. Baker feels safe.

It’s so much more than the law

I am a healer at heart. My undergraduate degree is in religion. I had once planned to go into the clergy. I satisfy this need now by being an Elder Law Attorney and by doing magic shows. Magic makes people feel good and is a lot easier than Elder Law but I have learned that being a magician and being an Elder Law Attorney take very similar skills. My clients and friends kid me by saying that in one act, I make handkerchiefs disappear and in another act, I make assets disappear. I think this is funny too but it also makes me feel uncomfortable.

Some people do not understand what I do as an Elder Law Attorney. Some people think that Medicaid planning means taking rich people and putting them on the public dole. This is not true.

Mrs.Baker is a composite of my average elder law client. Middle to upper middle-class families who’ve dutifully saved for retirement only to be beaned by a long-term care system that has spiraled out of control. What the government wants is for Mrs. Baker to “spend down” the family savings and then, when there is little or nothing left, Medicaid will help pay for the nursing home. The problem, of course, is that Mrs. Baker then has little or nothing left to pay for those things that Medicaid will not cover. All of their efforts in saving for a lifetime mean nothing. They get no benefit from having saved. Indeed, in the room right next to Mr. Baker, a lady who never saved a penny is receiving the same care on Medicaid.

Planning makes all the difference

Through proper elder law planning, I know I can show Mrs. Baker how to protect all or most of the family savings. I can show Mrs. Baker how she can qualify Mr. Baker for Medicaid while still getting the benefit of their savings. By using their own dollars and the government’s dollars, Mr. Baker (and Mrs. Baker) will be able to afford more and better care. This can make all the difference.

The New York Court of Appeals (NY’s highest court) put it well when they held that, “No agency of the government has any right to complain about, the fact that, middle-class people confronted with desperate circumstances choose, voluntarily, to inflict poverty upon themselves, when it is the government itself, which has established the rule, that poverty is a prerequisite to the receipt of government assistance, in the defraying of the costs of ruinously expensive, but absolutely essential, medical treatment.”

Peace of mind is possible

Mrs. Baker is every client who has walked into my office full of grief, guilt and fear.

For the individual person who comes to me, Medicaid planning can mean the difference between that person’s (or their loved one’s) life and death and it almost always means a higher quality of life for one’s last weeks, months or years. With each individual person or family who comes into my office, I can care only about them and making things better. I know that more money means more care. An elder law attorney, I can show my clients how to protect their savings and access Medicaid to get better care. Most importantly, what I am doing is not only legal, but is morally just.

Mr. and Mrs. Baker worked hard for their money. They helped to build this country. Whether we serve as Elder Law Attorneys, guardians or in another helping capacity, we should feel good about doing all we can to make Mr. and Mrs. Baker’s lives better. That is what gives me pleasure and I hope you can and do feel the same.

The Florida Bar

Elder Law Section Meeting

- Draft for practice. Don’t worry about being superfluous.

- “Schiavo” provision

- Religious or moral objection 7-day transfer provision

- Shield of Liability

- Enumerate important, controversial or oft-used rights even when granted by statutory default. For example:

- “Access to my Records: My Surrogate shall have all authority to access all of my clinical records, health care records, charts of all physicians who have ever treated me or been consulted regarding me, pharmacy records, insurance records, records regarding the provision of any medical equipment for me, records regarding ethics panels, hospital boards or others who have met regarding me, records of governmental agencies or providers to governmental agencies who have files regarding me even when those files are closed to the public but where I myself would have access and all other files or records regarding my health care. This grant of access applies to all media including paper files, audio files, video files or digital files of any nature.”

- “My Health Care Surrogate shall have the authority to direct the pertinent health care providers to withdraw treatment even if I myself requested the provision of that treatment or procedure during my capacity. For example, I may ask for the provision of a feeding tube or the means of delivering nutrition to me while I am competent but my Health Care Surrogate shall have the authority during my incapacity and consequent inability to communicate, to direct the withdrawal of that feeding tube. I recognize that my circumstances can change and I want my Health Care Surrogate to have the power to react to that change and to be able to act on my behalf. If my Health Care Surrogate, in his or her sole and absolute discretion, believes that I would not have wanted a particular procedure to be sustained or, if my wishes are unknown, that it would be in my best interest to withdraw the treatment, it is my desire and I hereby direct that my Surrogate be given the authority to withdraw such treatment.

- Multiple Surrogates

- In every single case, successor options and co-surrogacy options are discussed, pros and cons weighed.

- Enforcement. Comfort. Who is first?

- Precatory language

- Dual Empowerment: DPOA for Healthcare and HCS

- 709.2109: “ … a proceeding to determine incapacity does not affect the authority of the agent to make health care decisions for the principal, including, but not limited to, those provided in Chapter 765.” (emphasis added)

- Enforcement, damages and notice provisions of 709.2120 now in force for health care decisions.

- Funeral Tasks and Death Certificates: “Further, my designee shall have the right to execute my death certificate and sign any documents required by the funeral director on my behalf to finalize my funeral arrangements. For this purpose, my Health Care Surrogate shall be my “legally authorized person” as defined in Florida Statute Section 470.002(18).”

Summary

More than a year after full implementation of the Patient Protection and Affordable Care Act (ACA), this article summarizes the ACA’s fundamental consumer components and covers the state of the law, what has been learned over the last year, and how it affects the Special Needs and Elder Law practice. The ACA changes the way Americans of all ages obtain health insurance and receive health care. Although the new law radically expands health insurance coverage primarily for people under the age of 65, Medicaid and Medicare are also positively impacted by this life-changing legislation. The Medicare program for elders over age 65 and disabled individuals remains largely intact, but with expanded preventive care coverage and a narrowing of the notorious donut hole. The ACA expands Medicaid eligibility for many Americans and through subsidies makes private health insurance a viable choice for many people who once had to rely solely on Medicaid for their health care. Because pre-existing conditions are no longer a barrie to receiving health insurance, the law also will affect Special Needs planning and the use of special needs trusts. However, noticeably absent from the new law are provisions for long-term-care coverage and implementation of protections that could benefit the elder and special needs recipient in the long run. Advocates have new tools and new challenges in assisting health care consumers. Special needs and Elder Law attorneys who gain an early understanding of this life-changing, complex, and controversial law will “insure” their own relevance as the future of health care unfolds.

Read the full report here – Report on the Patient Protection and Affordable Care Act: Its Impact on the Special Needs and Elder Law Practice

The Small Print: This is an article on a fast-changing and complicated area of the law. The reader should not rely upon any information in this article as legal advice relative to a specific person or issue but rather should consult qualified counsel for up-to-date and customized advice and information.

I. An Introduction to the Medicaid Program

Medicaid is the primary government program which helps pay for long-term care. Medicaid pays all or some of the costs for home care, assisted living, nursing home care and other supports but only if a person is first proven to meet financial need standards set by the government.

Because Medicaid is both a state and a federal program, it means that we have 51 different Medicaid programs in the United States (all 50 states plus the District of Columbia participate) and the rules for each are constantly changing. Rules on who is eligible vary from state to state. Rules on what programs can be offered and how those programs are administered also vary. Because many clients have connections with more than one state, these differences create practical consequences in advice and is a fertile ground for malpractice claims. The Medicaid laws are based on federal statutes (mostly from Title 42 of the United States Code), state statutes, federal agency rules (e.g., the Social Security Administration, the Centers for Medicare and Medicaid Services, Internal Revenue Service), state agency rules (in Florida this is mainly the Florida Department of Children and Families, the Agency for Health Care Administration and the Florida Department of Elder Affairs), state court decisions, federal court decisions and agency opinion letters and rulings. Sometimes even more important are local customs and how each agency applies the rules and laws. These rules and laws are often created with little or no input from related agencies or law-making bodies. The courts have consistently referred to the Medicaid laws as the most convoluted and complicated of all of our legal systems with the possible exception of only the Internal Revenue Code.

People who work in long-term care are forced to become familiar with the Medicaid system but mistakes in interpretation and guidance are increasingly common as the rules become more and more complicated. Some facilities, banks and other institutions have brought knowledge in-house; others have outsourced for Medicaid experts. For the elderly, disabled and their families, many more are looking for advisors today than just 5 years ago. There are some very good advisors around but also some very ill-prepared advisors. The book of annual Medicaid denials in Florida is many inches think. This evidences the fact that people are seeking eligibility advice but are sometimes getting that advice from people who may be well intentioned but who have in fact given bad and harmful advice.

This presentation covers a very summary review of Medicaid eligibility and program issues designed for professionals in the elder care community and lawyers who focus on different (but often related) practice areas. These people are already in the field of improving peoples’ lives. At present, Medicaid is a very important tool in helping people through aging and incapacity.

II. Medicaid Programs in Florida

Medicaid is a very large umbrella under which smaller programs are administered. Each state has its own programs but there are more similarities than differences among them. In Florida, there are many different Medicaid programs and some drop off or are added as time goes by. The two programs covered here are Medicaid ICP and the Diversion Program, now falling under the “Florida Managed Care Long Term Care Program.” For ease of explanation, we will stay with the terms ICP Medicaid and Medicaid Diversion as described below.

A. Medicaid Institutional Care Program (ICP): This is the program which covers nursing home care in the majority of Florida nursing homes including those considered among the very best.

What does it cover? The program allows the family to choose the nursing home and pays the full cost of care at that nursing home less a “patient responsibility amount”calculated from income.

Which facilities accept Medicaid ICP? In general, only skilled nursing facilities can accept Medicaid ICP. An assisted living facility is not able to accept Medicaid ICP payments. Most skilled nursing facilities accept Medicaid in Florida including those considered among the very best. Nursing homes sometimes illegally hide the availability of Medicaid but this is rectified through using the right words and procedures during the admissions process.

How it works: Mrs. Baker selects the ABC Nursing Home for her husband. The nursing home normally charges $9,200 each month. Mr. Baker’s income, consisting of his social security and pension, is $2,100.00 each month. From that $2,100, Mr. Baker is allowed to retain (1) a “personal needs allowance” of $35.00 per month (the lowest allowed in the country) (2) a sum which gets transferred to Mrs. Baker to help her sustain household expenses and (3) a sum to reimburse for certain other allowed expenses. In this example, assume that this leaves Mr. Baker with $650.00 of income after subtracting out his personal needs allowance and the amount which can be transferred to Mrs. Baker. If this be the case, Mr. Baker pays $650.00 to the facility and the government pays the rest.

B. Medicaid Long Term Care Diversion Program aka Medicaid Managed Long Term Care: This program covers home and assisted living care in an attempt to divert people from nursing homes.

What does it cover? The program pays for a very full program of services and tools designed to prolong people living in their own homes or in assisted living facilities. The program can pay for home health aides, care management, social services, adult day care programs, respite care, home modifications, bath/shower visits, home cleaning, delivery of meals, electronic emergency notification systems and more. For people who choose to move out of the home, the program can pay assisted living costs. The amount of assisted living payments depend on the facility and separate negotiated agreements.

Which facilities accept Diversion payments? Over 7 million facilities can accept Diversion services in Florida! This is because Diversion services can be delivered in any Florida home plus many assisted living and other care facilities. The list of assisted living facilities participating in the Diversion program has grown rapidly since 2005 when funding was dramatically increased. I am proud to have been a part of the advocacy team that helped expand these programs.

How it works: Mr. Baker’s dementia has progressed rapidly over the past 6 months. Mrs. Baker, his wife and primary caregiver, is holding up well and is getting support but she needs more help with cleaning, personal care assistance and some respite. A case worker gets assigned to the case. The case worker evaluates Mr. Baker and speaks with Mrs. Baker about her needs and capabilities. With a full assessment in hand, the case worker sorts through and assigns appropriate services to the Bakers thereby delaying or avoiding nursing home placement. If Mr. Baker were appropriate for an assisted living facility, the program would pay for a portion of the assisted living costs. Sometimes the government contribution plus the elder’s social security check is enough the pay the full bill at the assisted living facility; other times, there is more a need for contribution. The amount given to the facility depends on how much of the facility’s cost can be attributed to care as opposed to room and board and this information must be presented to the government in the right way to get the fullest benefit.

There are other important Medicaid-related programs in Florida including Program for All-Inclusive Care for the Elderly (PACE) and some can qualify for VA benefits on top of Medicaid. Program eligibility rules vary and can be altered from time to time. Also, some programs have significant funding problems and wait-lists become necessary.

III. New Eligibility Standards

The system requires poverty before people can gain any help from the government for long-term care. The standards for eligibility are so onerous that people are forced into poverty, often spending their lifetime of savings in the last few years of life. By design, the system wants families to “spend down” assets to the Medicaid poverty limits and only then to go on Medicaid. The program with this approach is that while I may then get Medicaid, I have little or no money to pay for everything else I need. In other words, I am now indigent and on the government dole with little or no money left over to pay for all the things I need but for which the government will not pay. Moreover, if I have a spouse or others dependent on my financial support, those people are on their own because I will have nothing left. This is one reason why the field of Elder Law developed in the 1980s co-founded by my father, one of the true pioneers. Ethical Medicaid planning allows people to legally protect their savings while still qualifying for Medicaid. It is also possible to qualify for VA benefits.